At YWCA we work to ensure our program participants are equipped with the financial education necessary to achieve financial independence. YWCA’s Economic Resilience Initiative (ERI) is one of the longest running providers of financial education and holistic wellbeing services in King County, and the only provider of BankOn certified classes in the county. ERI started in 2006 as Hope and Power classes, which were an outgrowth of our Domestic Violence department. Our goal is to make sure our program participants obtain and maintain financial strength. For this week's blog, I spoke to Economic Resilience Manager, Hannah Haag to find out more about how our economic initiative programs work, the intersectionality between domestic violence and financial stability, and how to continue making a difference in communities of "under" and "unbanked" communities.

Why Financial Education Matters

According to the Council for Economic Education, it is never too early or too late to educate our community members on how they can become financially empowered. However, a recent study revealed that only 20 states require economic courses and Washington is not one. Additionally, surveys of the U.S. show there, ‘has been little increase in economic education in recent years and no growth in personal finance education.’

2004 was the first year the United States Senate recognized April as National Financial Literacy Month. Currently, approximately 9 million U.S. households are considered to be "unbanked," meaning those not served by a bank or financial institution. For communities of color, this is especially significant. As many as one in five black households and one in six Hispanic households are unbanked.

Let’s go back a bit and address the large percentage of unbanked black people and where that came from. The Freedman’s Bureau, created by President Lincoln, was meant to ensure freed slaves transitioned from being capital to becoming capitalists, thereby being paid wages for work done. After Lincoln’s assassination, everything that was meant to help the process was vetoed by Andrew Johnson. Since then, a lot black Americans, especially black Southerners will say in surveys, "I don’t trust banks. These institutions are not for us."

Many immigrants also say they don’t trust banks, and many low-income people who could afford a basic account but would have a minimal balance worry they may incur charges of $25 or more if they accidentally bounce a check or make some other error. According to the FDIC, the unbanked rate for Latinx households was 19.percent, compared to 7.7 percent for the population overall in 2009. Since then, unbanked rates have declined for Latinx, down to 16.2 percent by 2015.

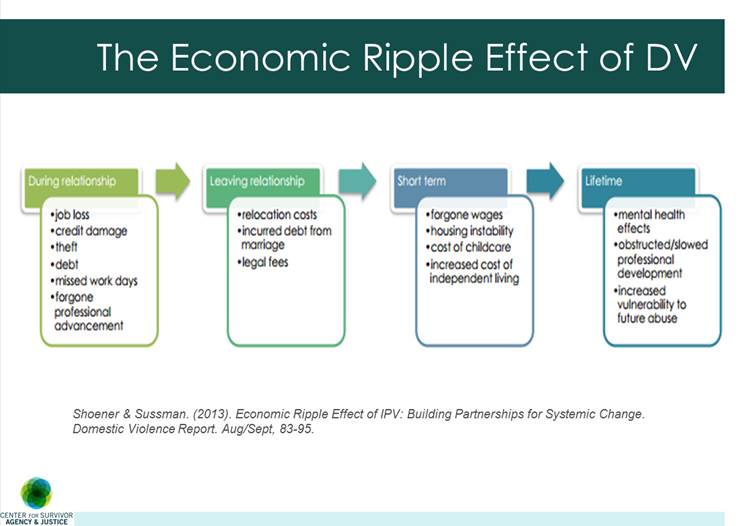

Program Manager Hannah Haag told me, " financial abuse impacts domestic violence survivors (DV) ability to leave. It's one of the top reasons women stay with their abusers. Many women come to our classes, which includes a module on financial abuse in week 1, and are shocked to learn that they had experienced financial abuse without ever realizing what was going on."

YWCA’s role in financial education

ERI is a client-and community-oriented program that focuses on providing dynamic financial education courses that promote healthy actions, positive mindsets, and change in personal finance. Their goal is to help participants become intentional, self-directed, and confident in their ability to make well-informed choices for their financial future. Hannah went on to say, " we highly customize our classes not only for low-income participants but also survivors of DV. Our Spanish classes are customized by language and culture and we only use speakers who can present in Spanish and are Latina. We also recognize that many of our participants are new to financial systems in this country. We help bride the gap while talking into account specific barriers that exist for our participants."

We currently have four core programs:

- Hope and Power and Esperanza y Poder: a ten-week learning experience in English or Spanish designed specifically for survivors of domestic violence who are interested in changing their relationship with money and moving forward in life.

- Money Mechanics and Manejando tu Propio Dinero: a four-week learning experience in English or Spanish designed for anyone in the community who is interested in moving forward and changing their relationship with money (not DV specific).

- Financial Coaching: for graduates of our classes, up to six months of customized one-on-one meetings with a qualified financial coach who will help you create and take your next steps toward financial freedom.

- Capacity Building and Technical Assistance: providing support, tools, and methodology for those working in the community to increase their own capacity around moving clients toward financial well-being.

Where do we go from here?

In closing, Hannah mentioned the importance in recognizing the impacts of DV or Intimate Partner Violence (IPV). "We see effects in our participants. Things like reproductive coercion, forced pregnancy, the impact on a woman's career, having a criminal record and attorney fees all factor into the cost of financial abuse." Educating the community is important to eradicate DV. YWCA's DV Advocacy programs protect the safety of survivors through community advocacy programs, support groups, and training for service providers, much like ERI.

The most recent S&P Global Financial Literacy Survey released showed that only 57 percent of adult Americans know basic financial literacy concepts such as interest compounding, inflation, and risk diversification, which means we must push for education and discuss financial literacy. We feel this education and life skills are best taught in schools, the workplace, and within communities. Community banks may be better solutions, especially if they offer commercial check-cashing services (CCO). For more information on our Economic Resilience Initiative, please contact Mike Schwartz, Regional Director of Economic Advancement.

Salma Siddick is the Social Media & Content Manager at YWCA Seattle | King | Snohomish. An immigrant from Zimbabwe, Salma has lived, worked, and attended school on three continents.

We share the stories of our program participants, programs, and staff, as well as news about the agency and what’s happening in our King and Snohomish community.